More Information …

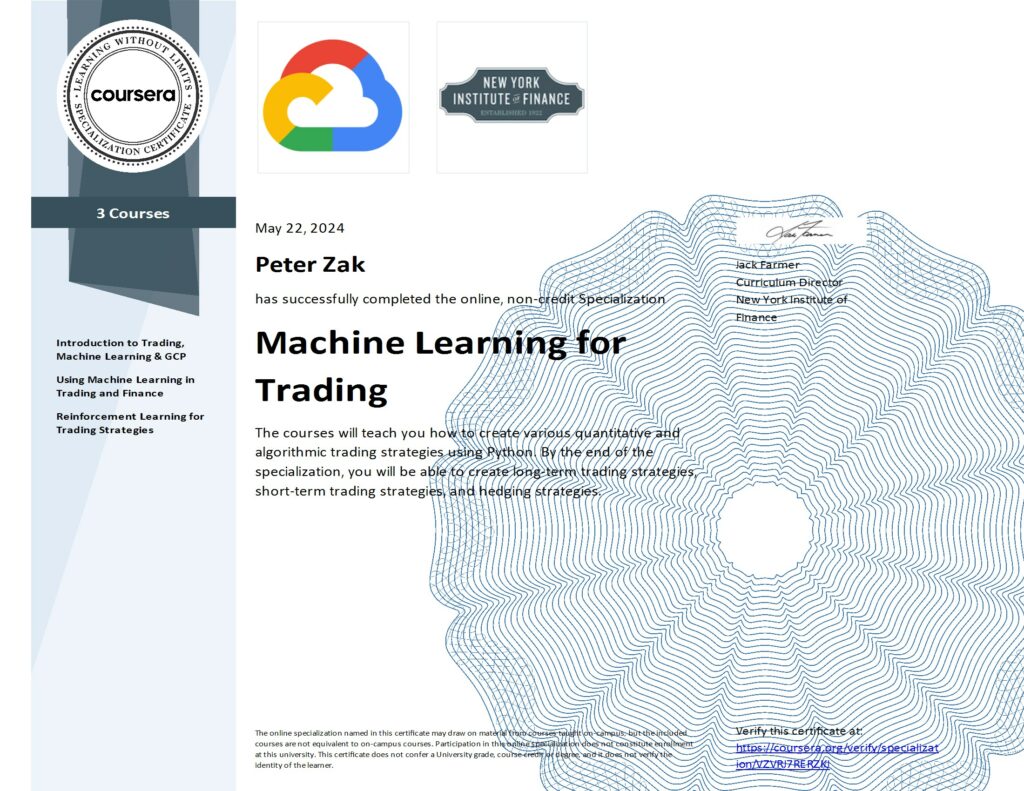

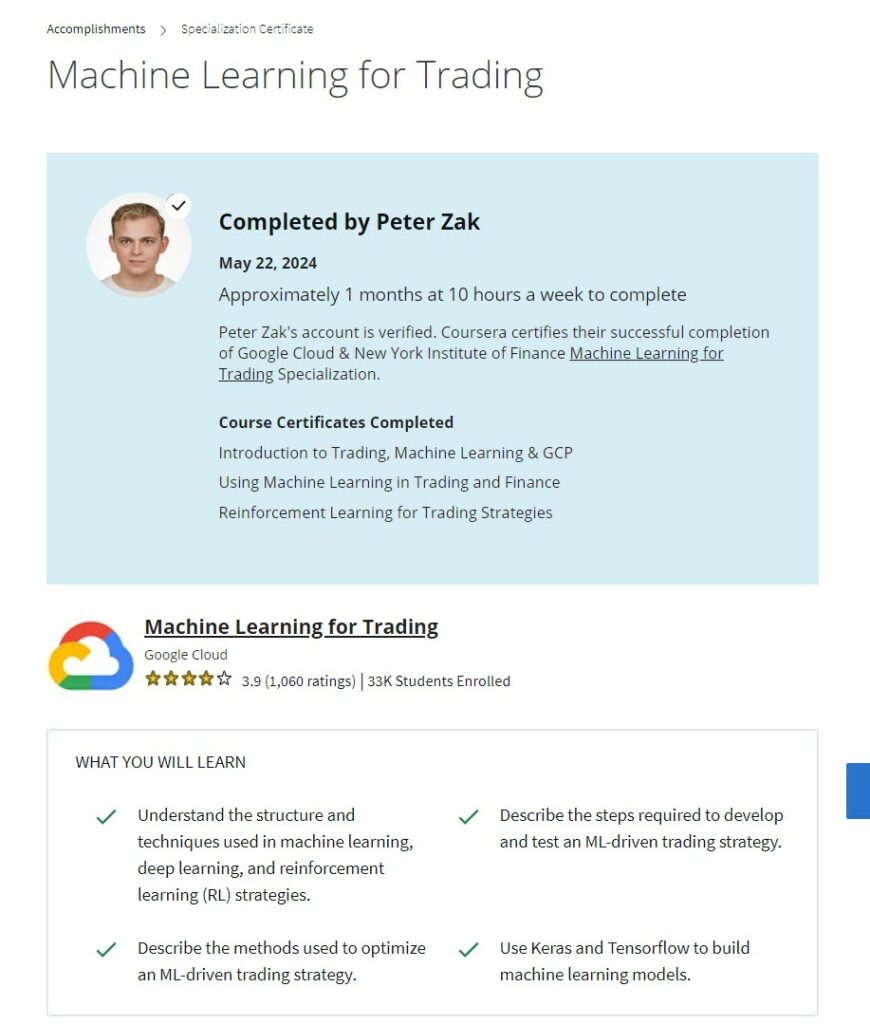

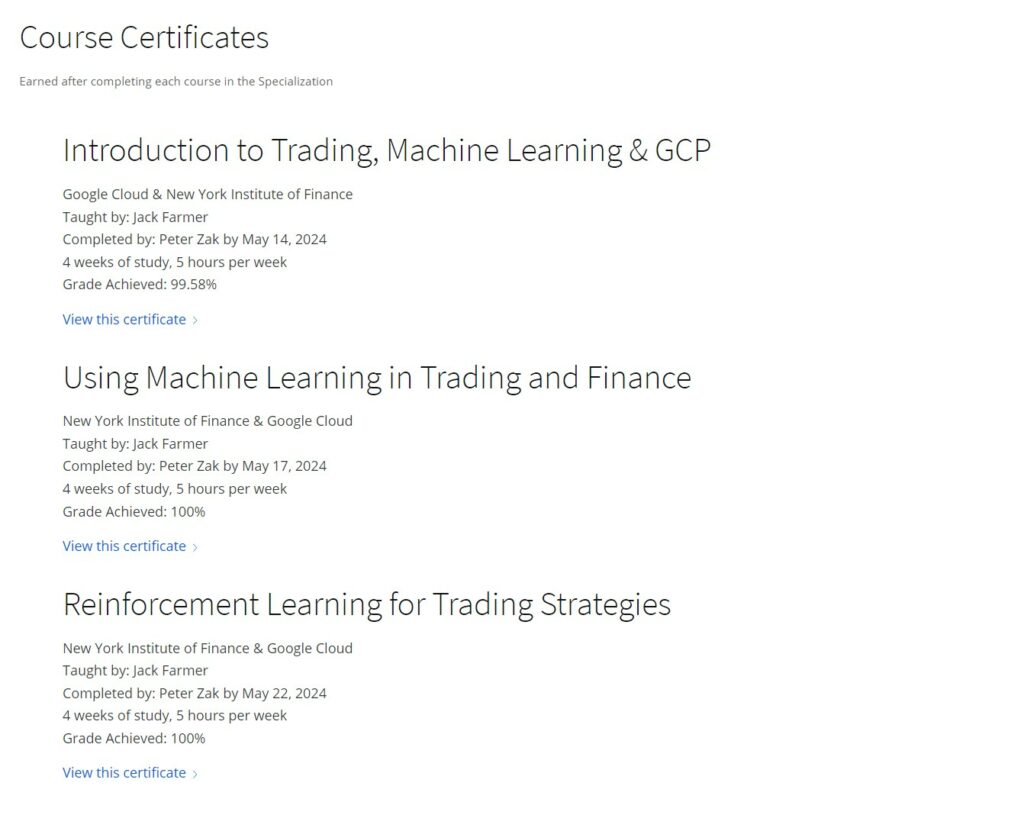

“This 3-course Specialization from Google Cloud and New York Institute of Finance (NYIF) is for finance professionals, including but not limited to hedge fund traders, analysts, day traders, those involved in investment management or portfolio management, and anyone interested in gaining greater knowledge of how to construct effective trading strategies using Machine Learning (ML) and Python. Alternatively, this program can be for Machine Learning professionals who seek to apply their craft to quantitative trading strategies. By the end of the Specialization, you’ll understand how to use the capabilities of Google Cloud to develop and deploy serverless, scalable, deep learning, and reinforcement learning models to create trading strategies that can update and train themselves. As a challenge, you’re invited to apply the concepts of Reinforcement Learning to use cases in Trading. This program is intended for those who have an understanding of the foundations of Machine Learning at an intermediate level. To successfully complete the exercises within the program, you should have advanced competency in Python programming and familiarity with pertinent libraries for Machine Learning, such as Scikit-Learn, StatsModels, and Pandas; a solid background in ML and statistics (including regression, classification, and basic statistical concepts) and basic knowledge of financial markets (equities, bonds, derivatives, market structure, and hedging). Experience with SQL is recommended.

Applied Learning Project

The three courses will show you how to create various quantitative and algorithmic trading strategies using Python. By the end of the specialization, you will be able to create and enhance quantitative trading strategies with machine learning that you can train, test, and implement in capital markets. You will also learn how to use deep learning and reinforcement learning strategies to create algorithms that can update and train themselves.”

More Information …

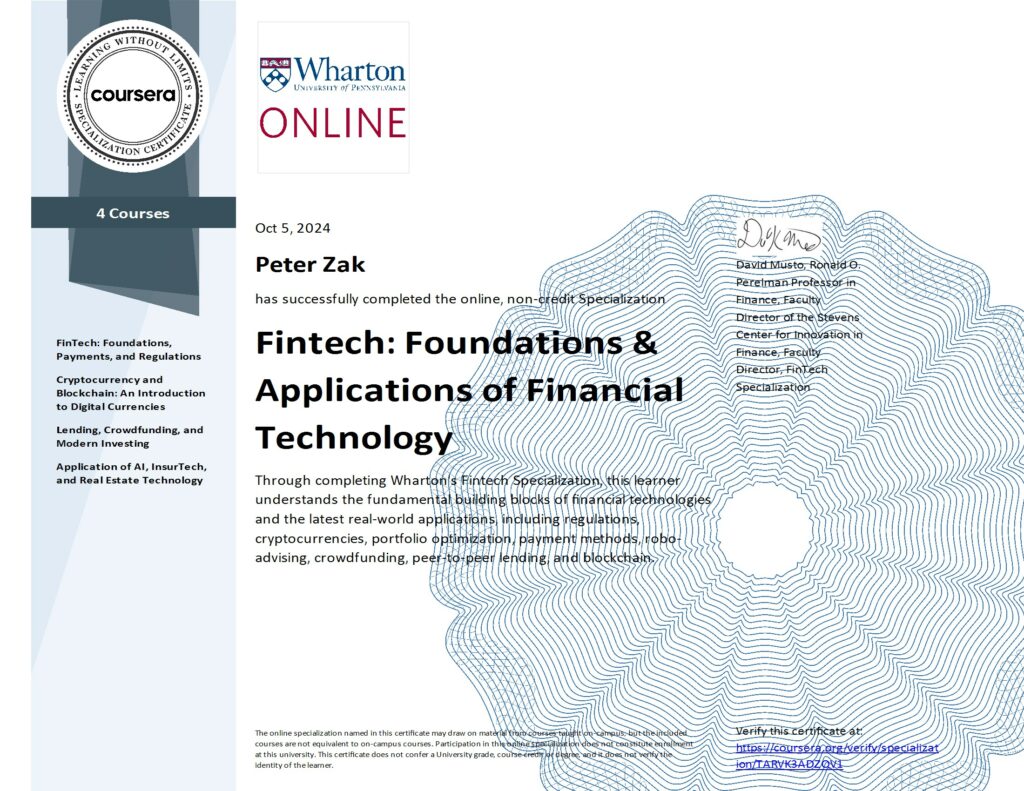

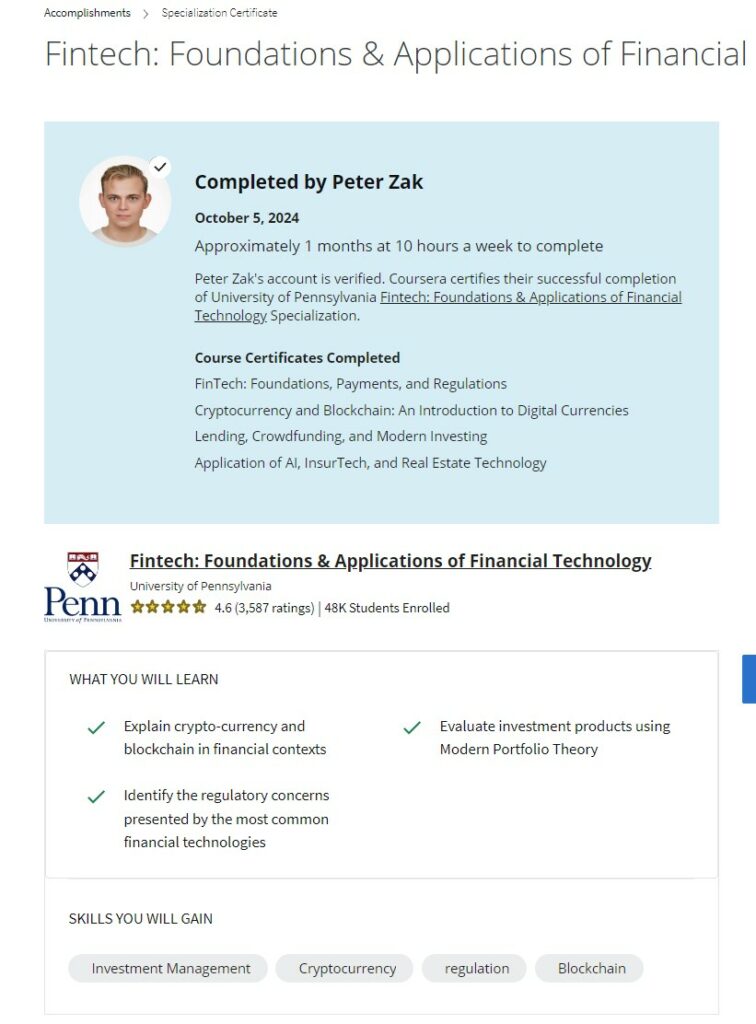

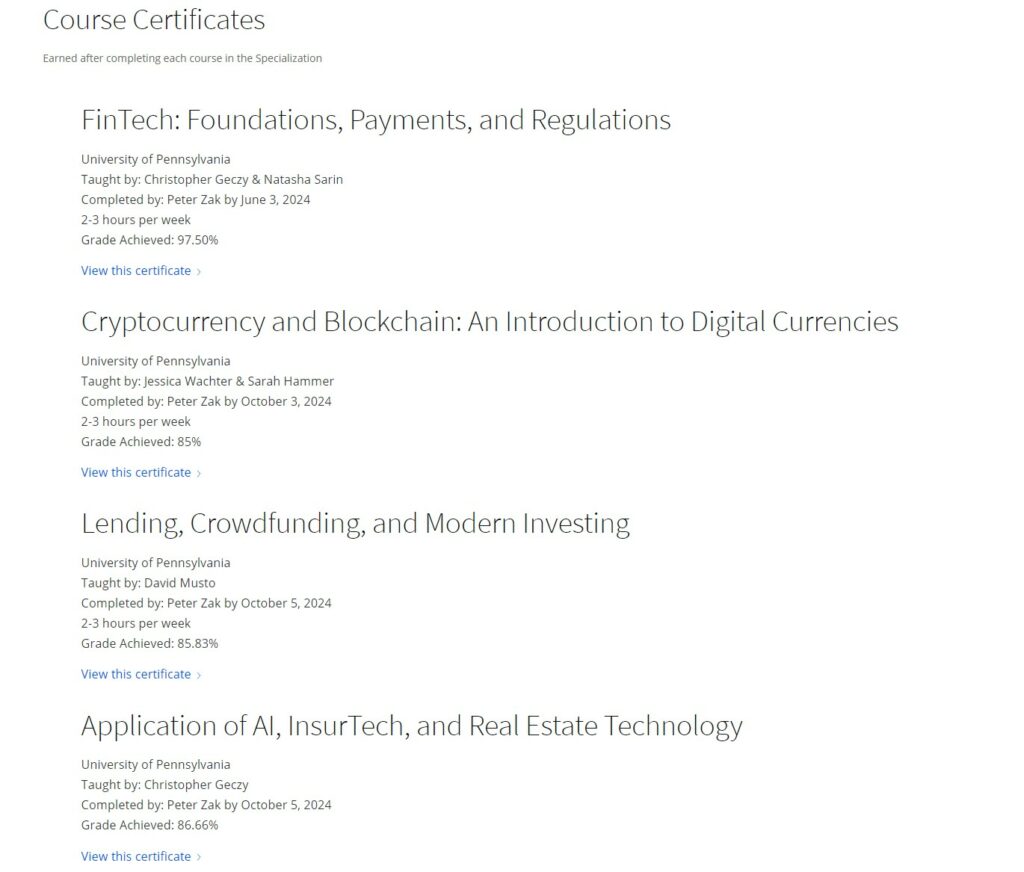

“Wharton’s Fintech Specialization is designed to introduce you to the fundamental building blocks of financial technologies and real-world applications through case studies of Wharton-led companies in the field. You’ll learn the the essential components of technology-driven financial strategies, from complex regulations to cryptocurrency to portfolio optimization.

You’ll also learn how modern investment strategies deploy technology to produce optimal results, explore the disruptive force of changing payment methods, analyze the changing regulatory landscape, and gain a deeper understanding of robo-advising, crowdfunding, peer-to-peer lending, and blockchain. By the end of this Specialization, you’ll be able to make informed decisions about deploying financial technologies for yourself or for your business, giving you a competitive advantage in using the latest financial innovations.he three courses will show you how to create various quantitative and algorithmic trading strategies using Python. By the end of the specialization, you will be able to create and enhance quantitative trading strategies with machine learning that you can train, test, and implement in capital markets. You will also learn how to use deep learning and reinforcement learning strategies to create algorithms that can update and train themselves.”

Applied Learning Project

You’ll learn the the essential components of technology-driven financial strategies, from complex regulations to cryptocurrency to portfolio optimization. You’ll also learn how modern investment strategies deploy technology to produce optimal results, explore the disruptive force of changing payment methods, analyze the changing regulatory landscape, and gain a deeper understanding of robo-advising, crowdfunding, peer-to-peer lending, and blockchain.

By the end of this Specialization, you’ll be able to make informed decisions about deploying financial technologies for yourself or for your business, giving you a competitive advantage in using the latest financial innovations.”

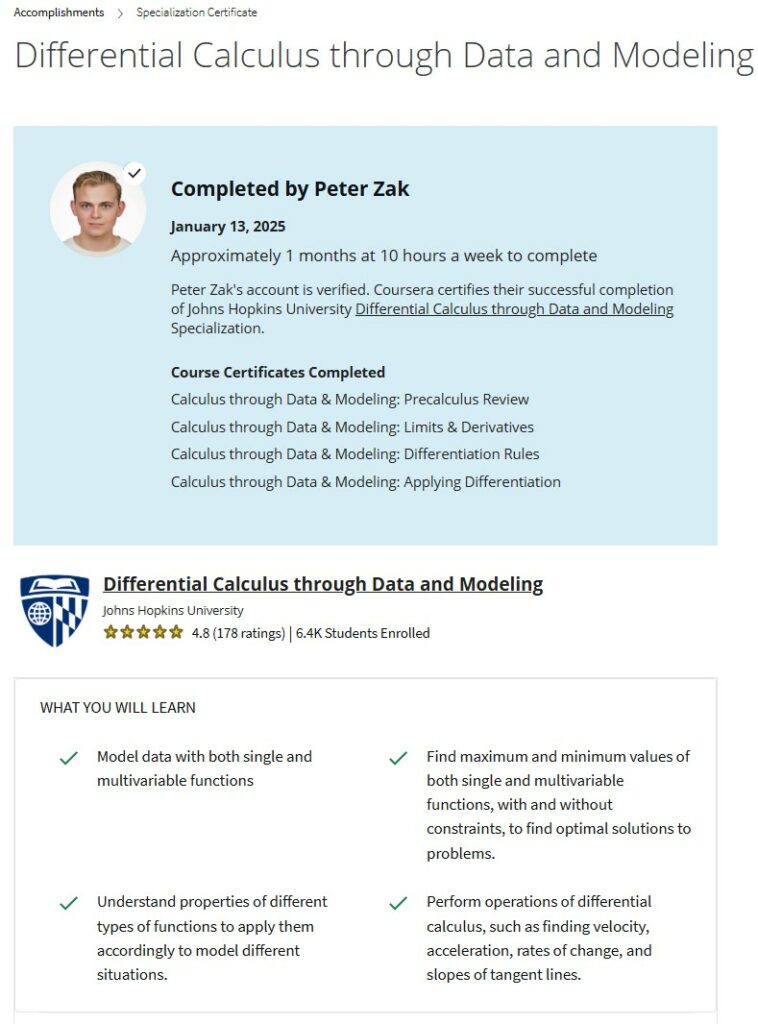

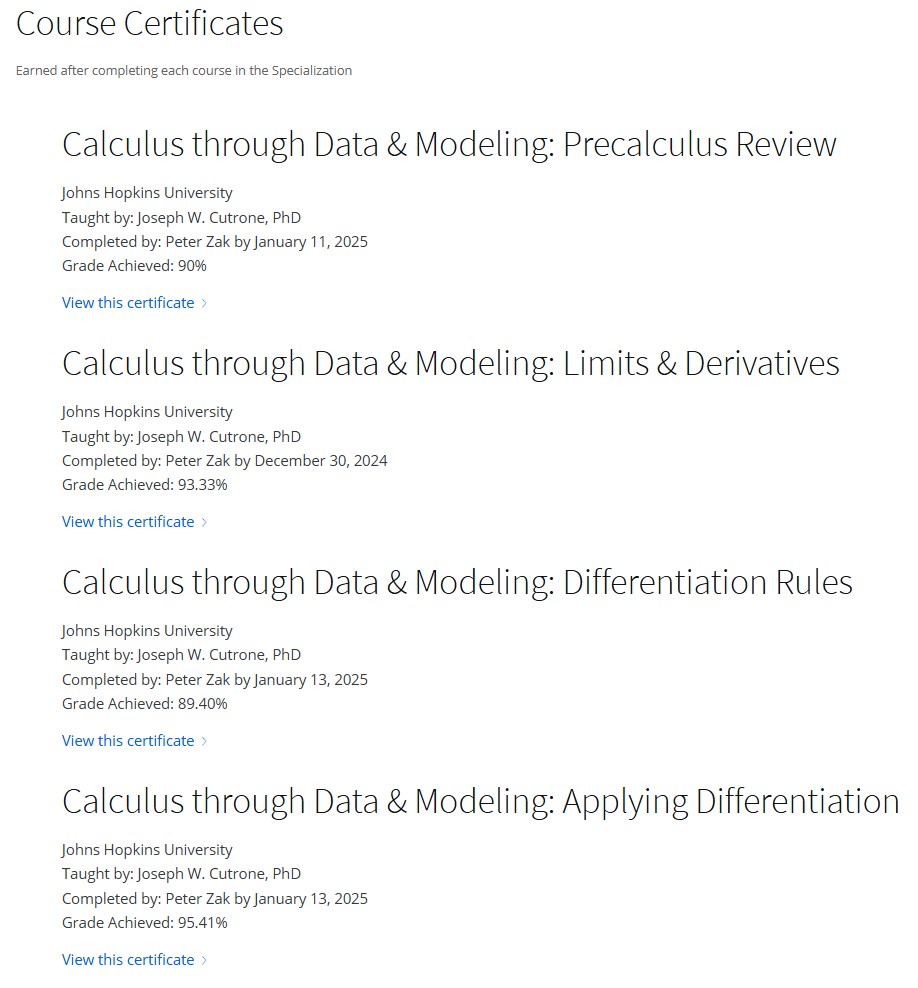

More Information …

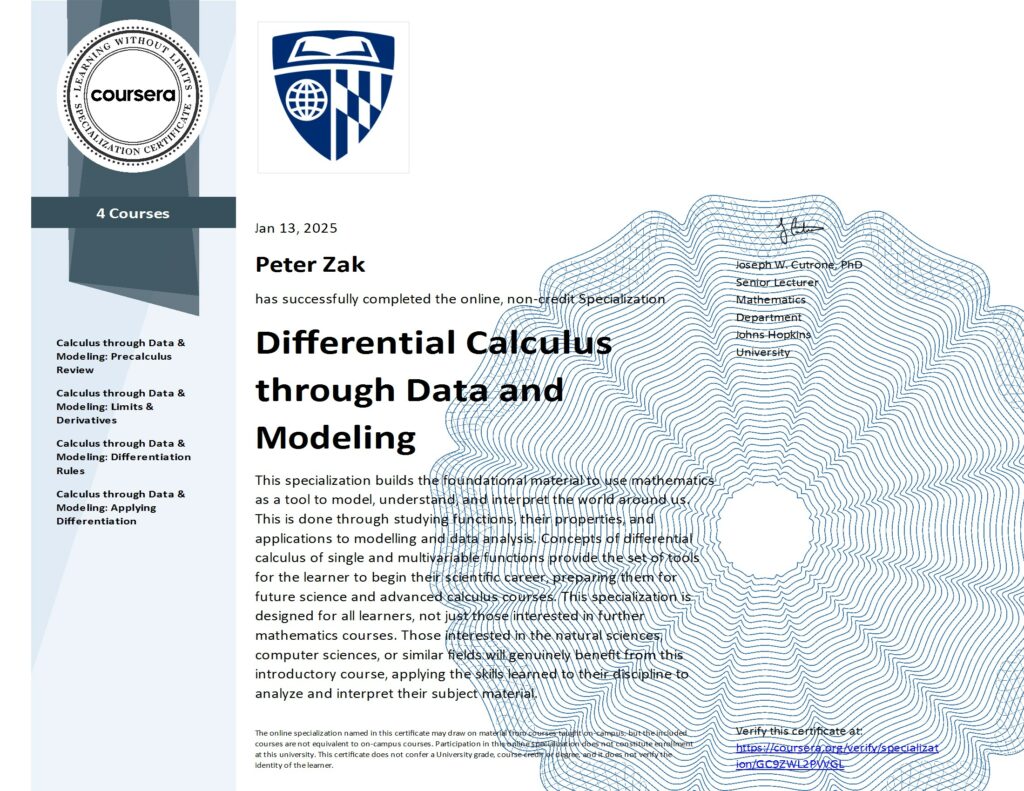

“This specialization provides an introduction to topics in single and multivariable calculus, and focuses on using calculus to address questions in the natural and social sciences. Students will learn to use the tools of calculus to process, analyze, and interpret data, and to communicate meaningful results, using scientific computing and mathematical modeling. Topics include functions as models of data, differential and integral calculus of functions of one and several variables, differential equations, and optimization and estimation techniques.

Applied Learning Project

In each module, learners will be provided with solved sample problems that they can use to build their skills and confidence followed by graded quizzes to demonstrate what they’ve learned. Through a cumulative project, students will apply their skills to model the cost of a construction project through a real topographical terrain with the goal of finding the optimal cost to complete the project.”

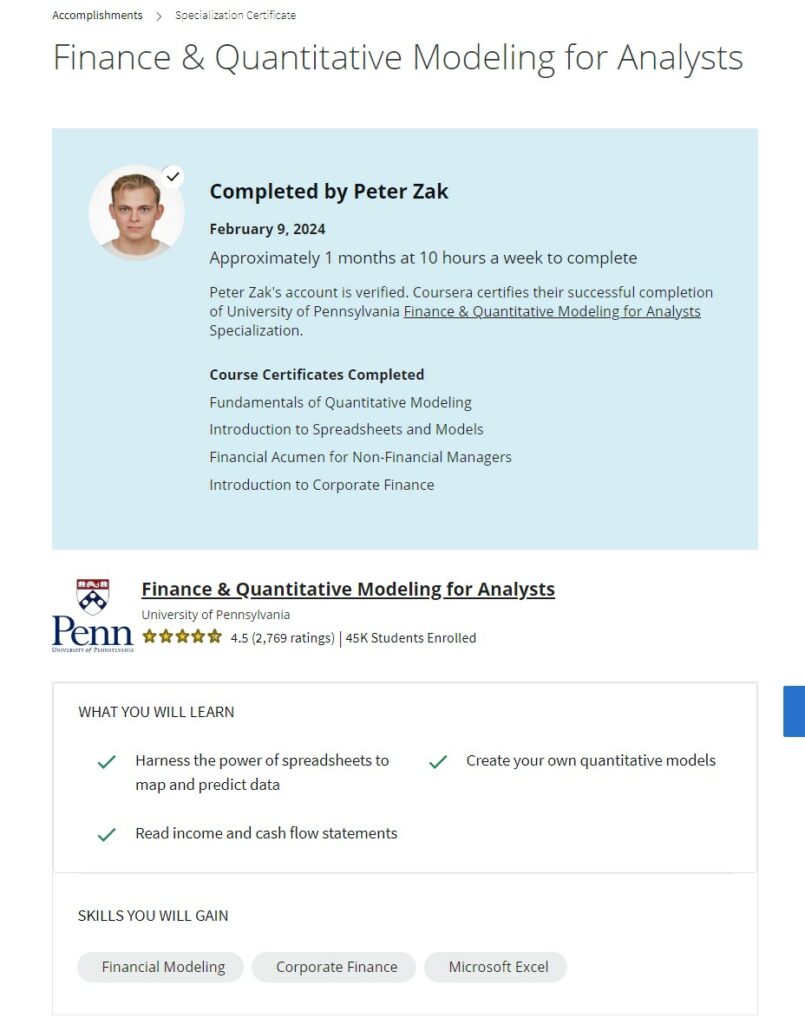

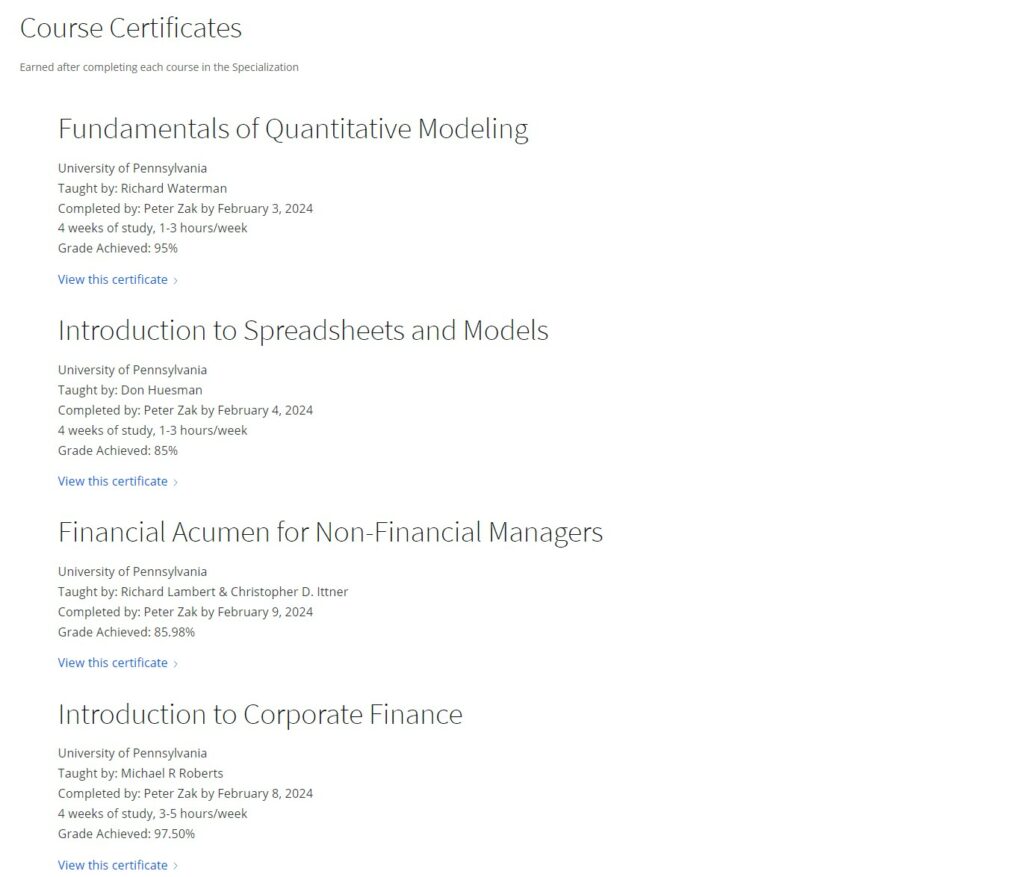

More Information …

“The role of an Analyst is dynamic, complex, and driven by a variety of skills. These skills range from a basic understanding of financial statement data and non-financial metrics that can be linked to financial performance, to a deeper dive into business and financial modeling. Analysts also utilize spreadsheet models, modeling techniques, and common investment analysis application as part of their toolkit to make informed financial decisions and investments.

This multifaceted specialization will equip a learner who might be interested in entering the dynamic world of data and business analysis, and/or is interested gaining deeper technical knowledge in Finance and Quantitative Modeling. Starting from the fundamentals of quantitative modeling, you will learn how to put data to work by using spreadsheets and leverage spreadsheets as a powerful, accessible data analysis tool. You will also be introduced to the world of corporate finance, and gain a better understanding of finance fundamentals, including a variety of real-world situations spanning personal finance, corporate decision-making and financial intermediation.

Applied Learning Project

The role of an Analyst is dynamic, complex, and driven by a variety of skills. These skills range from a basic understanding of financial statement data and non-financial metrics that can be linked to financial performance, to a deeper dive into business and financial modeling. Analysts also utilize spreadsheet models, modeling techniques, and common investment analysis application as part of their toolkit to make informed financial decisions and investments..”

More Information …

More Information …

More Information …

More Information …

More Information …

More Information …

More Information …

More Information …